Defining Inflation and Its Causes

does the president control inflation Inflation is defined as the rate at which the general price level of goods and services rises, leading to a decrease in purchasing power. It is a crucial economic concept that affects both consumers and businesses. Economists primarily measure inflation through price indices, such as the Consumer Price Index (CPI) and the Producer Price Index (PPI). Understanding inflation involves examining its various causes, which can be attributed to multiple factors interacting within the economy.

One of the significant types of inflation is demand-pull inflation, which occurs when demand for goods and services surpasses supply. In this scenario, as consumers increase their purchasing power and demand more products, businesses respond by raising prices. This phenomenon can be further driven by factors such as increased consumer confidence, government spending, or lower interest rates, which contribute to the overall increase in demand.

Conversely, cost-push inflation arises when the costs of production for goods and services escalate, leading to higher prices. This situation often occurs due to rising wages, increased raw material costs, or supply chain disruptions. When businesses experience higher costs, they are likely to pass these expenses on to consumers, resulting in inflated prices. Additionally, external factors such as geopolitical events or natural disasters can create supply bottlenecks, further exacerbating cost-push inflation.

Other causal factors include built-in inflation, stemming from adaptive expectations of wage increases, and monetary inflation driven by an excess supply of money in the economy. Furthermore, inflationary pressures can also be influenced by fiscal and monetary policies, making it essential to consider the role of government and central banking institutions. As such, the interplay of these various factors creates a complex economic landscape that fundamentally impacts the stability of inflation, which is crucial for understanding presidential influence over economic conditions.

The Role of the President in Economic Policy

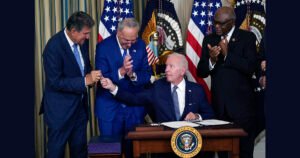

The President of the United States plays a pivotal role in shaping economic policy, which directly influences inflation rates and overall economic stability. While the President does not wield absolute authority over the economy, their powers encompass several critical areas, including fiscal policy measures, budgetary control, and regulatory actions. These tools can be utilized to promote growth, manage inflation, or address economic downturns.

Fiscal policy measures are one of the primary ways through which the President can exert influence over the economy. By proposing changes to taxation and government spending, the President can stimulate economic activity or curtail it, depending on the prevailing economic conditions. For instance, during times of recession, a President might advocate for tax cuts or increased public spending to spur demand and reduce unemployment, ultimately impacting inflation levels. Conversely, during periods of economic expansion, the government might implement measures to tighten fiscal policy in an effort to control rising prices.

Additionally, the President has significant control over the federal budget. This control allows the President to prioritize funding for specific programs which can help in addressing inflationary pressures. Through budgetary decisions, the administration can influence sectors such as infrastructure development, education, and healthcare—each of which can indirectly affect inflation by altering supply and demand dynamics in the economy.

The effectiveness of the President’s economic policies is also moderated by the compilation of economic advisors and cabinet members. These individuals bring expertise in areas like finance, commerce, and labor, allowing for a comprehensive approach to economic challenges. Their insights assist the President in formulating responses that can mitigate or exacerbate inflation.

Overall, while the President holds considerable influence over economic policy through various mechanisms, the complexities of the economy and external factors often limit the effectiveness of any single action taken by the administration. Understanding these dynamics is crucial for comprehending the broader context of inflation and economic leadership.

External Factors Affecting Inflation

The dynamics of inflation are often influenced by a myriad of external factors that can extend beyond the direct control of the President. One significant contributor to inflationary trends is global market fluctuations. The interconnectedness of world economies means that spikes in demand or disruptions in supply across major markets can reverberate domestically, leading to changes in pricing. For instance, an increase in oil prices due to geopolitical tensions can escalate transportation costs, consequently raising the price of goods and services. These international economic distortions highlight the extent to which domestic inflation is tied to global circumstances.

Another critical factor is the enduring impact of the COVID-19 pandemic. As economies began to reopen after lockdowns, demand surged; however, supply chains were still reeling from the disruption caused by the pandemic. This mismatch resulted in significant inflationary pressure as prices of essential commodities and services increased. The pandemic has exemplified how public health crises can lead to economic instability, further elaborating that factors out of a president’s control can significantly affect inflation rates.

Additionally, international conflicts and trade policies can introduce uncertainties, influencing inflation. When countries engage in trade disputes or military confrontations, the result often translates into increased tariffs and disrupted trade flows. Such an environment can lead to constrained supply and ultimately escalating prices for consumers. Supply chain disruptions, exacerbated by both conflicts and the pandemic, underscore the vulnerabilities that modern economies face. Taken together, these external factors contribute to a complex web of influences that dictate inflation, highlighting the challenges any president might encounter in seeking to manage it effectively.

Case Studies of Presidential Impact on Inflation

Throughout history, various U.S. Presidents have faced the challenge of managing inflation through their economic policies and legislative actions. A notable case study is President Richard Nixon’s administration from 1969 to 1974, which encountered soaring inflation rates amid the Vietnam War and oil crises. In an attempt to combat this phenomenon, Nixon implemented wage and price controls in 1971. While this strategy provided temporary relief, it ultimately led to shortages and further economic issues, illustrating the limited effectiveness of direct governmental intervention in regulating inflation.

Another significant example is President Jimmy Carter’s tenure during the late 1970s, characterized by rampant inflation that peaked at around 14%. Carter’s policies, which included an emphasis on energy conservation and the deregulation of certain industries, were met with mixed results. The economic strain led to public frustration and perceptions that his administration was ineffective in handling rising prices. Carter’s experience reflects the complex relationship between presidential influence and inflationary trends, as his actions aimed at stabilizing the economy did not yield the desired outcomes.

does the president control inflation Conversely, President Ronald Reagan’s economic approach in the 1980s is often viewed as a pivotal shift in dealing with inflation. By adopting supply-side economics and implementing significant tax cuts, Reagan sought to create a more favorable environment for investment and growth. While inflation rates were high at the beginning of his presidency, they fell dramatically by the end of his second term, largely attributed to the Federal Reserve’s interest rate hikes combined with his administration’s fiscal policies. This case suggests that while presidential actions can indirectly influence inflation, the collaboration with independent entities like the Federal Reserve is crucial for effective economic management.

These historical examples underscore the challenges U.S. Presidents face in controlling inflation through policy decisions. Though their influence is significant, it is often limited and interwoven with a myriad of external economic factors, public sentiment, and institutional responses. Understanding these dynamics provides insight into the role of leadership in shaping economic stability.